Markets Rally as Cooler Inflation Strengthens Bets on Fed Rate Cuts

Cooling inflation and strong earnings lifted markets. As investors bet on Fed rate cuts despite tariff tensions and limited economic data.

Man checking sports results on mobile device screen via stock photo Getty Images

Man checking sports results on mobile device screen via stock photo Getty ImagesA softer-than-expected U.S. inflation report for September boosted investor confidence. Traders are now expecting the Federal Reserve to cut interest rates at its upcoming October meeting and again in December.

Major U.S. indexes finished Friday higher, notching their second consecutive week of gains. The S&P 500, Nasdaq Composite, and Dow Jones Industrial Average each climbed around 2% for the week.

The easing Inflation data added momentum to markets already buoyed by a strong corporate earnings season. So far, 87% of reporting companies have exceeded Wall Street’s expectations well above the usual 67% beat rate, according to LSEG. Analysts say that if Big Tech delivers strong results this week, stocks could reach new record highs.

However, President Donald Trump’s decision to impose an additional 10% tariff on Canadian imports over a recent ad has reintroduced trade tensions. Also tempering some of the optimism. Economists warn that tariffs could add upward pressure on prices. Although the consumer price index came in below estimates, the annual inflation rate in September rose slightly to 3% from August’s 2.9%.

“Inflation might not be slowing but it’s not surprising to the upside anymore,” said David Russell, global head of market strategy at TradeStation.

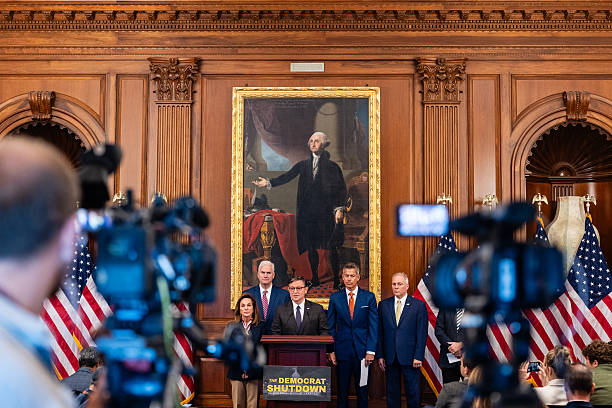

With limited data available due to the ongoing U.S. government shutdown. Including the missing jobs report. Economists caution that investors still lack a complete view of the economy’s performance. Making the rally potentially fragile.

While speaking of holding steady under pressure. Just like markets need strong anchors during uncertain times, climbers rely on secure gear such as the PETZL OK Carabiners SCREW-LOCK built for reliability when it matters most.

Conversation